Learning

Center

|

|

Model

Portfolio

|

|

|

|

GCM Model Portfolio

Globe Capital Management, Corp., being committed to

trading excellence is constantly refining its strategies by learning from

proven sources of trading mastery, as well as its own past mistakes. Part

of our quest for improvement involves actual trading experience. GCM's

Model Portfolio is our showcase of what we believe to be, sound trading

practices. However, this should NOT be construed as rendering any

investment advise, nor a recommendation of any techniques, products or

services, or to buy or sell specific securities. We firmly agree in Van K

Tharp belief that, the secret of the "Holy Grail" is found

within one self.

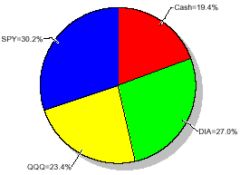

Portfolio

Statistics

Since

Inception as of 10/31/02*

|

Current

Allocation

|

|

|

Performance

|

Performance |

GCM

Portfolio |

S&P

500 |

|

|

Month

to date |

9.39% |

14.85% |

|

Quarter

to date |

9.10% |

14.85% |

|

Year

to date |

-0.72% |

-18.45% |

|

|

1

Year |

-0.75% |

-17.88% |

| 3 Years |

N/A |

N/A |

| 5 Years |

N/A |

N/A |

| 10 Years |

N/A |

N/A |

| Since Inception |

4.26% |

-8.52% |

|

Reward/Risk

|

| Best Quarter |

4Q

2001 |

5.73% |

| Worst Quarter |

2Q

2002 |

-7.13% |

| Best Year |

|

N/A |

| Worst Year |

|

N/A |

| Annual

Return |

4.26% |

| Max. drawdown |

15.39% |

| Reward/Risk

Ratio |

0.28 |

| Standard

deviation |

3.64% |

|

Reliability**

|

|

Total Closed Trades |

30 |

|

Winning Trades |

19 |

|

Losing Trades |

11 |

|

Reliability |

63.33% |

|

Expectancy**

|

|

Expectancy |

Total |

Per Trade |

Avg |

|

Positive |

8.60 |

0.29 |

0.45 |

|

Negative |

-9.44 |

-0.31 |

-0.86 |

|

Net |

|

-0.03 |

|

|

|

|

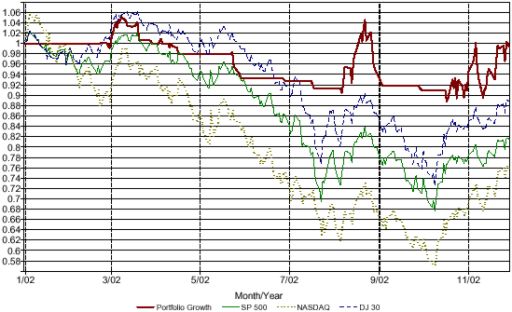

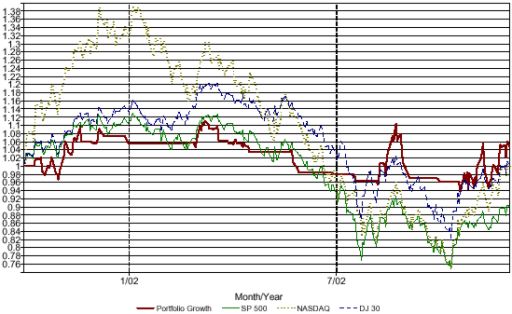

Performance

Charts

|

|

Year

to Date

|

|

Since

Inception

|

* Updated monthly. Charts and data processed with

Captools software and proprietary spreadsheets. Performance

net after management fees. Certain fixed expenses and taxes

excluded. 1,3,5, 10 Years, and since inception returns are

annual compounded. 1,3,5, and 10 Years figures are based on

trailing periods. Standard deviation based on latest 12 month trailing period

** Updated only when one or more open positions

are closed.

|

|